0 Comments

I recently had the opportunity to present at the inaugural Virtual Music Conference, held in February 2013. It is a completely online music conference presented by IndieConnect, an organization that promotes and educates the independent music community. I was asked to present by the NY chapter of IndieConnect. I created a 2 part presentation entitled The Dynamics of The Digital Music Business. The first presentation, Music Business Overview, focuses on how digital has been transforming the music industry and some upcoming trends in the business on the horizon. The second presentation, Implications for Musicians, focuses on how the digital music business and tools are affecting musicians and how to take advantage as a musician on the amazing opportunities available today thanks to "digital." Both presentations are "entry level" discussions: intended for audiences that are less familiar with what digital music means to them. Each are about 50 minutes. You can watch the 2 videos here, or on Digital Daruma's YouTube Channel. Enjoy!  I recently participated in 2 panel discussions at the inaugural CBGB's Music Festival in NYC. One was on the future direction of the music business, and the other was on what were great apps for indie musicians to use. I was interviewed after the sessions by Indie Connect. Here's the video. I think the next decade is an exciting time for the music business. With technology as its backbone, the digital music business model will see mass adoption by music listeners, a fundamental shift toward sustainability of the long tail artist, and the final chapters in the industry power base away from the major labels, hopefully with a more egalitarian and diverse musical artistry that will reflect digital music’s promise.

As renowned futurist Paul Saffo has pointed out: “It turns out it takes 30 years for a new idea to seep into culture. Technology does not drive change. It is our collective response to the opinions and opportunities presented by technology that drives change.” It has already been a decade since Napster disrupted the cozy monolithic business model controlled by an oligopoly, and in many respects the music business’s issues that stifle progress remain the same. As Ted Cohen of TAG Consulting recently pointed out, “enough talking” has taken place over the last decade without “enough action.” Many of the progressive changes to the business that were enabled by technology (streaming, internet radio, P2P, etc) have been very slow to get broad traction, but if Paul Saffo’s right, the next decade will be the time where there’s going to be a lot of “action:” most of it in the direction of redefining a new music industry paradigm that will have long term sustainability. At the most basic level, the music business today lacks two things to adapt quickly to the accelerated adoption by consumers and artists of the new ways music is consumed and created: 1. There is no concrete legal foundation that allows for substantial long-term and sizable investments to create the new business model efficiently. Without a safe legal construct for copyright holders, performers, audience and digital media companies to exchange payments for services that are reasonable to all parties, the evolution to the new business model of music will be slower and will have a harder time reaching critical mass. P2P is the prime example of a well-adopted method of consuming media that an easy legal fix could be adopted (e.g. statutory royalty rates for "new" methods of distribution, or perhaps some form of compulsory “tax” on ISPs, computer manufacturers, phone services) save for the stubborn behavior of the “old business” community. 2. The incumbents of the old business model, exemplified by the major labels, aren’t willing to adapt. Even under mounting evidence that the value of recorded physical music is in massive decline, the oligopoly is extremely slow in changing strategic direction. This is truly unfortunate, since the labels are actually in the best position to invest and experiment with the new business model. Instead, in my opinion, they’re now long past that point of no return, with EMI’s recent default and restructuring as the “Barbarians At The Gate” of the major labels’ collective hubris. This ostrich-with-head-in-sand approach has unfortunately left the digital music businesses lacking in a needed source of investment capital, too much legal tension between old and new, and has left emerging artists lacking in sufficient financial backing (as a whole) to yet create a sustainable long-tail music business. My view is that both of these issues will be resolved in the coming few years. If so, it’s not so hard to see that a modernized legal framework for digital music will allow non-music and media business investors to seriously invest in the new model, which ironically will close the final chapter of the major labels’ stranglehold on their power over the musicians and fans. This investment and realignment of power away from the old model is what will ultimately redefine the music business holistically, where, even if the basic recorded music is “near free” for fans, artists and the middlemen will create a profitable new ecosystem. The direct music business revenues will probably be smaller in aggregate (at least for a while) but the distribution of wealth will be far more egalitarian, and importantly more in favor of the creator of the music than evident today. From my perspective, ideally, all this will lead to a sustainable long tail artist “enterprise” style model where: • Integrated artist management companies will emerge that “bank” the development of emerging talented artists in a symbiotic, not exploitational way. • Artists will earn 30% of the revenues, not “5% maybe”; their business partners will earn the same. The rest of the revenues will go to marketing, promotional partners and other expenses. • Revenues will be earned in a myriad of ways that represent a realignment of revenue sources for the business (concerts, licensing, merchandising, streaming etc.) The key to this holistic approach is a mutual alignment of interest around artist success. Fortunately, the new model creates many more opportunities to monetize the music and access to fans. The businesses that support artists will ideally balance artistic and creative integrity with modest profit expectations. My predictions include: 1) The music business will lose many of its “boundaries” whether geographical, or otherwise. Great music and artists exist everywhere in the world, and promoting all music and musicians to all the world’s music fans should be the mission of the music business. Separately, in the digital era, the velocity of commerce (given any given song gets played or downloaded in any of the now 1,000+ digital music services companies globally at any moment) screams for greater global integration of the c’s and p’s, if not in legal terms, at least in “best practice” commercial terms. Also, music should be less about what it is at a particular moment in time (generally a discrete “composition”) and more about a communal and ever changing art form that is in constant change (e.g. mashups, fan remixes, evolving compositional changes over time, different artist collaborations). Music was always meant to be a dynamic experience, and digital can actually get us back to that. 2) Music does not become completely subordinated to other leisure and media forms. Almost all generations have reduced their consumption of music as other forms of media (e.g. DVDs, video gaming, and cable TV) have provided both greater variety of content and greater value to the consumer. Music is essential to the success of all these other media experiences, but creating music solely for consumption in other media forms feels like “work for hire,” not an aesthetic art form. Also, let’s keep music from becoming a loss leader for other business objectives, like Google’s failed attempt in 2009 to put Spotify on their new NexusOne phone, footing the licensing bill, all in an effort to sell more phones! Music should be important enough that it’s not created solely for some other commercial objective. It will be interesting to see both Google and Apple's streaming music offering later this year. 3) The new music world will allow for great music to be created and enjoyed by all who share the artist’s efforts. Artists, ideally, will continue to create music because it is important to them and has a message, as oppose to profitable or easily consumed by the mass public. For instance, the increasingly “ADD” nature of the music and media community makes “music as art” a much more difficult endeavor. Who will create the next “Dark Side of the Moon,” “London Calling,” "Songs In The Key Of Life," “Sgt Pepper’s Lonely Hearts Club Band,” "The Grey Album" or “Kind Of Blue” when the demand on the surface seems to be focused on image and single downloadable hits? The “free” single-track era of music has some undesirable side effects that hopefully a more mature digital music business can counteract. 4) Music will be democratized for the fans. Personal choice will be king. Music we like will fit our tastes and desires, not selected for us by the media pushers. We will have choices for discovery of new music, whether it’s Pandora, Pitchfork, or a P2P playlist from your friend in India. We will experience music as we choose: streaming, concerts, downloads, videos on demand wherever we are. Music will integrate seamlessly into our lives, being enjoyed alongside other media that we find worthy of our time and money. We will no longer passively listen to music. Rather we will participate and interact with our favorite music and artists; whether that is making our own mix from stems from our favorite artists, creating videos for them, or giving them the thumbs up (or down) for the experience the artists shared with us. Most importantly, we will be willing to pay fairly for this plethora of experiences that music in the new digital world will provide us, especially since the artist will get paid for their efforts to entertain us. So, the music world of the near future will be dominated by digital as it’s medium to deliver an unparalleled array of experiences to the audiences everywhere. Access will trump ownership. It will be ubiquitous. It will be intertwined with the broader media and entertainment business. It will be more global than today. It will provide the greatest opportunities every seen for artists with great music to create sustaining careers. All this I expect will accelerate over the next decade. Today, about 80% of digital download revenues comes from less than 15% of the consumers, according to TAG Consulting. This represents an enormous opportunity (and uphill struggle) to convert the casual music fan to change behavior to embrace all the opportunities that the new music business model will enable. The music business will adapt quickly in this coming decade to facilitate this far vaster horizon of opportunities. This future is no longer a dream. The base technology is already there to take us there, and we are just waiting for a few changes in business norms, a fresh set of players, and an adoption from the broader consumers, who will find the combination of ubiquity, service and choice irresistible. The ideal music business model, as its simplest goal, should put the creator of the music back in control of the destiny of their art. Those who admire that art (i.e. the fans) should be provided barrier-less connectivity to the art and the artist. The communal aspects of the music, like sharing music with friends, should be effortless and legal. There should be ample avenues for discovery of new music built around personal preference. The business of music should be about facilitating and enabling this series of experiences between artist and fan globally, with no prejudice toward geography, genres or “revenue land-grab” agendas. After all it’s the music business: where music comes before business. “If you wanna change the world shut your mouth and start to spin it” ~ Cracker

[Note: originally written in January 2010] Fundamentally, the music industry’s biggest challenge today is that recorded music is now free, or close to free, to the consumer. The historical reliance on physical music sales cannot be the focal point for the industry’s future. This has led almost all aspects of the industry into a transformational state in what is now the second decade since Napster began disrupting the traditional revenue model. From my perspective, a few of the bigger issues that derive from this “digital-music-as-a-free-commodity” reality include: 1) The struggle for balance between copyright owners and the pliability of digital music. Most digital music advocates claim existing copyright laws are outdated and inappropriate for the global music world of digital downloads, ubiquity, sampling and streaming. Copyright owners, including the record labels, are protecting existing catalog rights, fighting piracy on legal grounds and lobbying heavily for royalties from new sources, like webcasting. Despite continuous attempts to mediate these disparate views, there continue to be inequities and a lack of a satisfactory solution to safely move forward. In finance, I personally experienced how an unclear legal framework can stagnate business development, and how markets can thrive once a legal foundation exists. Establishing the appropriate legal and royalty framework for the digital music world represents the most critical step in creating a solid ground for the new music business model to grow. 2) The long tail music model paradox. Thanks to the wonders of digital music, the amount and styles of music the listener can access and how the listener accesses it continues to grow exponentially. But matching the listener’s taste to this vast sea of music has become an enormous challenge for artists, labels, managers, marketing firms and service providers. The successful paradigms for how artists and compositions cut through this digital static will have a profound impact on the business model for music going forward. 3) The elusive new profitability model. The music business revenue mix is shifting away from recorded music sales to publishing, concert, media licensing, merchandising, and digital data and support services. Today very few focused on the recorded music business are making significant bottom line profits, with large incumbents, like the major labels, losing money. Even promising digital start-ups (like Pandora) at best are breaking even still, but with very little revenue scale built into their operating model. Until more success stories at a business level emerge from this transformation, investment capital will continue to be scarce and unevenly distributed. Pandora Killed The Radio Biz?

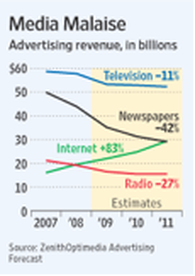

[Note: originally docuemented in December 2009. All data references are from mid- to end of 2009.] “Video Killed The Radio Star” by The Buggles ushered in a new era as the first music video ever broadcast on MTV in 1981. MTV revolutionized how audiences discovered music, successful artists were created, and record companies marketed their songs. Today, the confluences of digital music, declining advertising revenues and rapid adoption of mobile devices are challenging the traditional radio business model. I thought it would be useful to quickly research the state of play in the "radio business." A real easy way was to compare at a high level what a large commercial radio station (I picked WHTZ “Z100” based in the NY metro area) versus an Internet radio service (I picked Pandora) offer to artists, record labels and consumers. I think this will help us can begin to appreciate the radical transformation taking place in how people discover and listen to music. Z100 is a flagship station of Clear Channel Communications, the largest owner of radio stations in the US. Z100 is the top Pop Contemporary Hit Radio (“CHR”) station in the New York metro area, reaching approximately 3 million people daily. Pandora was launched in 2005 as a monetization mechanism for the Music Genome Project, a database associating 400 musical attributes to artists and songs. Pandora offers “stations that play only the music you like,” with 40 million registered users and 3 million daily listeners (in late 2009). Pandora is the most popular Internet radio station today with a market share of 40% (as of summer 2009). Internet radio delivers music through web and mobile applications, ideal for its customized experience. Commercial radio broadcasts through the airwaves, allowing ubiquitous access to a large audience. Most major stations also simulcast via the web and mobile apps. Z100’s content is determined by music charting services (like Billboard), which have an elaborate system reviewing airplay and music sales to determine popularity weekly. Pandora builds DJ-less custom radio stations around an artist or song chosen by the listener. A playlist is then created based on songs with similar attributes from their database. In 2007 Pandora played over 90% of its catalogue each day, and Pandora now hosts 700,000 songs (2009 data). Pandora represents the long tail of music, in stark contrast to the 120-song rotation for Z100. For artists, airplay on CHR has historically provided the greatest exposure to large audiences, and getting plays signaled that the artist has “made it.” However, Billboard today ranks medium rotation on Z100 as only the twentieth best promotional method (the highest radio ranking), reflecting the multitude of media outlets for artist promotion today. Pandora’s algorithmic playlist gives far more artists limited airtime. Digital services like Pandora pay royalties to performing artists, not just the composers, as in commercial radio. For labels, commercial radio continues to be the most effective way for their music to quickly reach broad audiences. Despite a steady decline, commercial radio still reaches 91% of the US population. Beyond airplay, other promotional opportunities (in-studio performances, interviews etc.) exist on Z100 that Pandora cannot offer. Internet radio’s significantly narrower 17% penetration rate highlights commercial radio’s continued importance in reaching listeners. Internet radio stations pay licensing fees to labels to access their catalogue. For labels, songs aired on commercial radio are a cost, while Internet radio represents a revenue stream. For consumers, music anywhere at anytime was a promise only the airwaves could provide since broadcast radio began in the 1920s. In return for this ubiquitous access, listeners are limited to selecting the genre, with stations determining advertising and programming unilaterally. Pandora gives listeners more granular choice (i.e. artist or song), and allows control over their customized broadcast’s timing. Pandora’s mobile application has increased their reach, with 10 million users now registered via the iPhone. A more personalized experience and broader access are the primary reasons for Pandora’s accelerating popularity. Both Z100 and Pandora are free for listeners, and advertising revenues dominate in supporting programming and operating costs. Clear Channel’s radio revenues were over $700 million for their third quarter in 2009, down 17% from the previous year. By contrast, Pandora will reach $40 million in revenues this year. So, why should commercial radio be concerned about such a small upstart? As shown below, advertising revenues are dramatically shifting from traditional media to the Internet as brands rethink their strategy toward targeted marketing. Pandora’s large audience and selectable demographics represent an attractive alternative to commercial radio’s mass marketing approach. Citadel Broadcasting, the third largest radio station owner, has recently declared bankruptcy due to revenue declines and leverage. Clear Channel currently has $20 billion in debt, which many view as detrimental given advertising revenue trends. As wireless dashboards get introduced, Internet radio is entering the last stronghold of commercial radio’s ubiquity, the automobile, where 35% of radio listening takes place.Pandora will be built into Ford’s Sync system, possibly available in 2011. Commercial radio will no longer be the sole medium for ubiquitous music access. Pandora is far from perfect. Its advertising dependent business model has yet to prove scalable, given its royalty and licensing fee structure. True ubiquity is still a promise, not reality. Pandora does not give listeners full control over what gets played. Subscription based digital music services, such as Rhapsody, MOG and Spotify provide listeners with more music, greater content control, and have similar discovery features to Pandora. When these streaming services become widely available via mobile and in cars, a compelling alternative to Pandora and commercial radio will emerge. Google’s rumored attempt to bundle Spotify into its Nexus One phone and foot the music licensing costs clearly indicates how powerful the combination of ubiquity and music choice is. Podcasting represents another competitor to format based radio. A truly personalized listening experience can be created from a myriad of content (music, news, weather, sports, special events, etc.) readily available today. One company, RadioWeave, recently launched an application that delivers this array of content. A customizable platform that offers user selected podcasts integrated with music streaming would compete effectively with radio. Clearly, commercial radio will be forced to evolve given the pressures in its existing business model and as better choices emerge for listeners. This new personalized radio experience, like many disruptive innovations, will be adopted quickly. Recently, radio business consultant Mark Ramsey warned radio executives: “you are not in the ‘Radio Business’ anymore.” It feels like the perfect time to pen the song “Pandora Killed The Radio Biz.” Maybe The Buggles are still around? Hi everyone.

I will be using this space to periodically broadcast my findings and views on the digital music ecosystem, as I see it. Very much looking forward to comments, feedback and engaging with all of you out there who are excited about the future of music in the digital world. It would be of great satisfaction if I can provide a bit of insight once in a while. To start, I'll post a few articles I wrote early last year (2010) that is really a representation of my perspectives, after studying the changing dynamics of the music industry for just a few months. Welcome to Darumusings! |